From Chaos to Compliance: How to Start the New Year Without IRS Debt

Every January, millions of taxpayers and small business owners start the new year with the same resolution: get right with the IRS. Yet for many, the cycle of unfiled returns, ignored notices, and mounting penalties continues. The reason is not always irresponsibility. It is often overwhelm. The U.S. tax system is complex, notices are confusing, […]

The Importance of Tax Planning: How Smart Decisions Before Year End Can Save You Thousands

Tax planning is one of the most powerful financial tools available to individuals and businesses. The way you approach the calendar year determines whether you pay more in taxes than necessary or keep those savings to reinvest in your goals. Someone once told an IRS auditor that the border between tax avoidance and tax evasion […]

One Big Beautiful Bill: What It Means for Your Business

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) became law, reshaping how businesses, especially small and growing ones, plan their taxes. This sweeping legislation makes popular provisions permanent, restores critical deductions, and creates new opportunities for entrepreneurs and investors. At more than 1,000 pages, the bill is ambitious in scope, and while […]

🆕 IRS Fresh Start Program 2025: What Idaho Taxpayers Need to Know

By Ilir Nina, CPA | Idaho Tax & Bookkeeping Services If you’re living in Idaho and feeling overwhelmed by IRS tax debt, you’re not alone. Many taxpayers find themselves struggling to keep up with balances, penalties, and interest. Fortunately, the IRS Fresh Start Program was designed to give people like you a real path toward […]

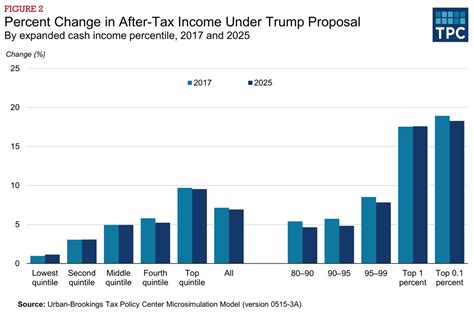

What’s Expected Under the New Trump Tax Law and the Likelihood of Passage

Introduction In his new term, President Donald Trump has introduced a series of tax reform proposals designed to provide financial relief to various groups, promote economic growth, and address inequities within the tax system. These proposals span several areas, including Social Security taxes, income tax reforms, the State and Local Tax (SALT) deduction, the carried […]

Your January Tax Filing Checklist: Getting Ready for Tax Filing Season

Ilir Nina CPA, EA,MSAT January marks the beginning of tax season—a time when individuals and businesses need to gather their financial information and prepare to meet the IRS’s filing deadlines. Whether you’re filing on your own or working with a tax professional, starting early and staying organized can make the process much smoother. This comprehensive […]

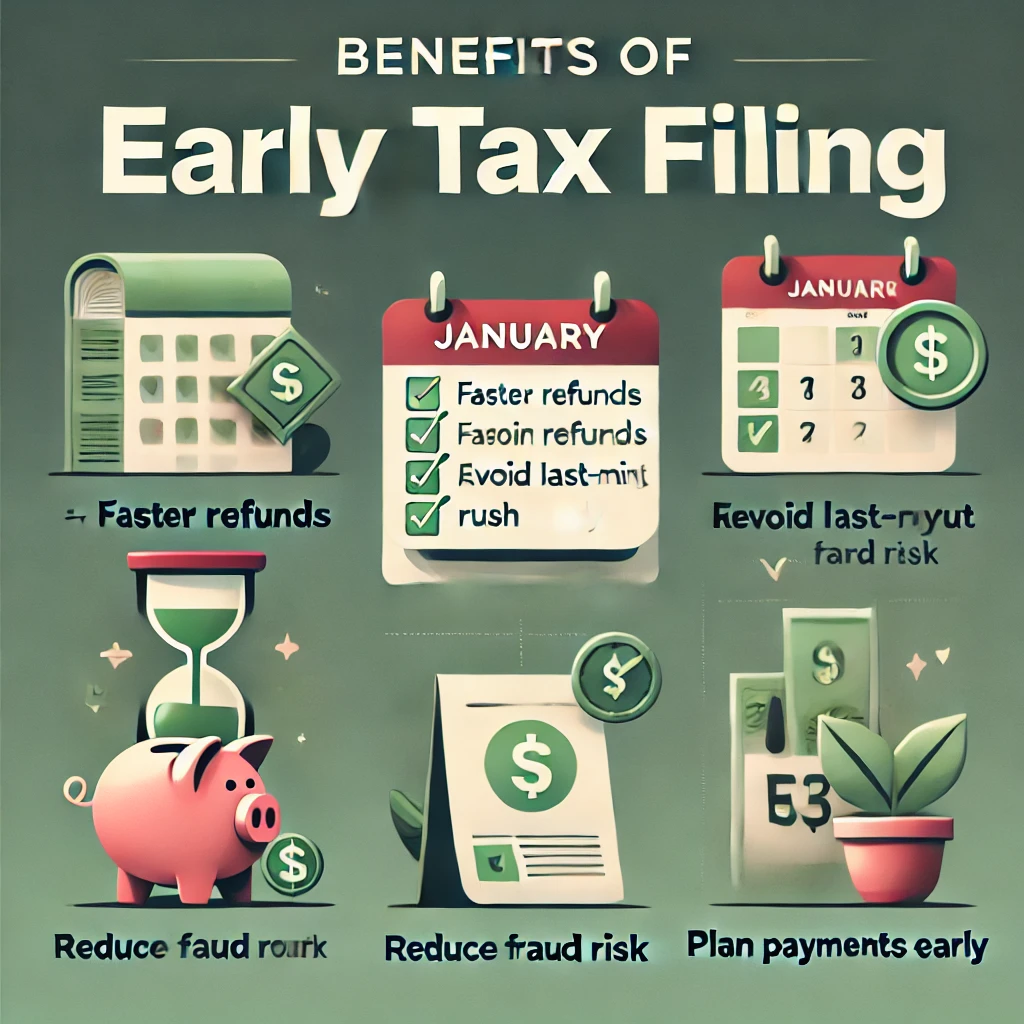

The Benefits of Early Tax Filing: Why January Is Your Friend (Idaho and Federal)

Tax season may seem like a time of stress and deadlines, but it doesn’t have to be. While the final tax filing deadline for most individuals is mid-April, there are numerous advantages to starting the process early and filing your taxes as soon as possible. In this blog, we’ll explore the benefits of early tax […]

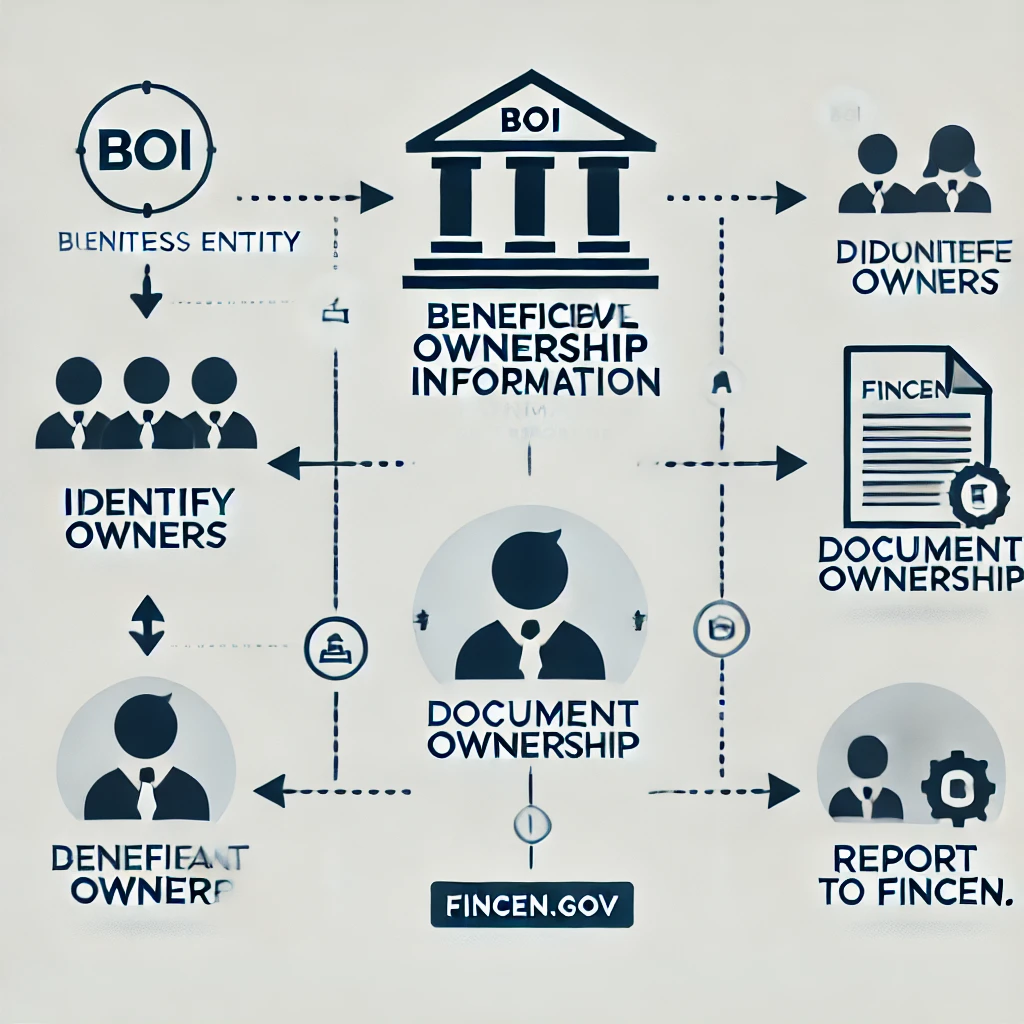

The FinCEN BOI Reporting is Back: What You Need to Know

After a brief pause and much anticipation, the Financial Crimes Enforcement Network (FinCEN) Beneficial Ownership Information (BOI) reporting requirements are once again in effect. Businesses and entities across the U.S. must prepare to navigate these requirements to ensure compliance. Here’s what you need to know: New Deadline Update The reporting deadline for existing entities has […]

How Cryptocurrency Transactions Are Taxed

Cryptocurrency has emerged as a revolutionary financial asset, captivating investors, tech enthusiasts, and even skeptics worldwide. However, as with any asset, governments have imposed tax regulations on cryptocurrencies. Understanding these tax implications is essential for individuals and businesses involved in buying, selling, or holding cryptocurrencies. This blog aims to provide a comprehensive overview of how […]

Common Holiday Spending Mistakes That Lead to Tax Problems Next Year

The holiday season is a time of joy, celebration, and giving—but it can also be a financial minefield for many taxpayers. The combination of festive cheer and societal pressure often leads to overspending, which, if not carefully managed, can create cash flow challenges and set the stage for tax problems in the coming year. As […]