Understanding the Nexus for Income Tax: Rules and Regulations

Introduction Income tax is a critical aspect of fiscal policy and economic regulation. It funds essential public services such as healthcare, education, and infrastructure. The term “nexus” in the context of income tax refers to the connection or link that a state has with a business or individual that obligates them to pay taxes within […]

Maximizing Tax Savings Through Like-Kind Exchanges

Introduction A like-kind exchange, also known as a 1031 exchange, is a powerful tool for real estate investors to defer capital gains taxes when selling an investment property. Named after Section 1031 of the Internal Revenue Code, this strategy allows investors to sell a property and reinvest the proceeds into a new, similar property, thereby […]

Tax Breaks for Higher Education Expenses in Idaho

Tax Breaks for Higher Education Expenses in Idaho Higher education can be a significant financial burden for many families, but fortunately, there are several tax breaks available both at the state and federal levels that can help alleviate some of these costs. In Idaho, residents can benefit from a variety of tax incentives designed to […]

Tax Rules in Idaho -Vacation Home Rentals

Renting out a vacation home can be a rewarding and profitable endeavor. However, navigating the tax implications can be complex. Understanding and adhering to tax rules is crucial to avoid legal complications and to maximize the financial benefits of your rental property. Here’s an in-depth look at the essential tax-related rules and guidelines for vacation […]

Understanding Business Use of Vehicles: When is Your Drive a Commute, Personal, or Business Use?

Understanding Business Use of Vehicles: When is Your Drive a Commute, Personal, or Business Use? In the business world, vehicles play a crucial role in day-to-day operations, from delivering products to meeting clients. However, distinguishing when a drive counts as commuting, personal, or business use can be complex. This distinction is important for tax purposes, […]

Fair Compensation for S-Corporation Owners: Finding Balance and Compliance

Introduction As the owner of an S-corporation, determining your compensation can be a complex and nuanced process. On one hand, you want to ensure you’re fairly compensated for your contributions to the company. On the other, you need to navigate IRS regulations to avoid potential audits and penalties. In this blog post, we’ll explore the […]

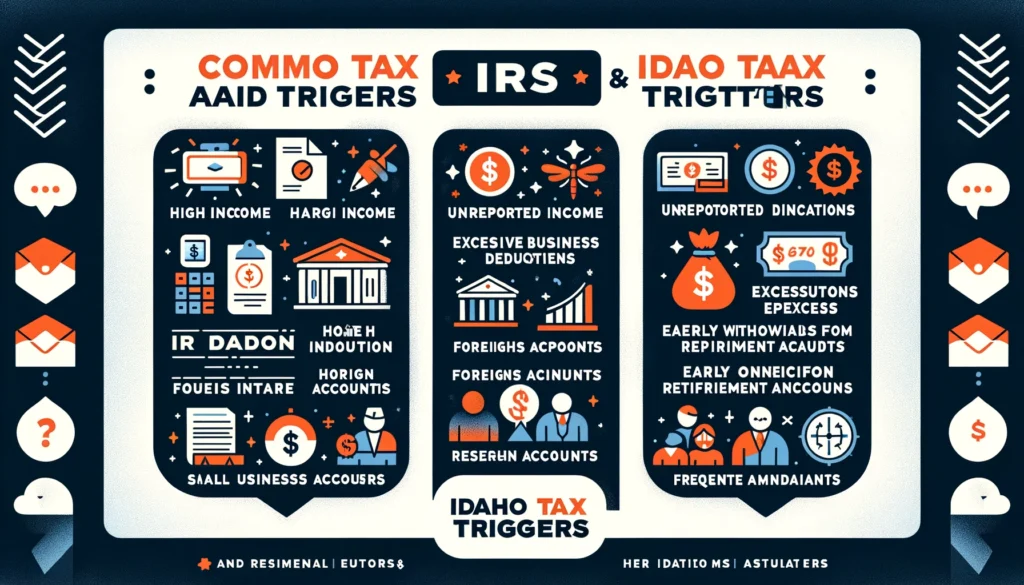

IRS and Idaho Tax Audit Triggers: What You Need to Know

IRS and Idaho Tax Audit Triggers: What You Need to Know Tax audits can be a daunting prospect for any taxpayer. Understanding what might trigger an audit can help you navigate the complexities of tax filing and reduce the likelihood of facing one. This article will explore the common triggers for audits by both the […]

Mid-Year Tax Planning in Idaho: Strategies to Maximize Your Tax Savings

As the calendar flips past the midway point of the year, Idaho taxpayers have a golden opportunity to assess their financial standing and explore avenues for minimizing their tax liabilities. With specific considerations unique to the Gem State, effective tax planning can lead to substantial savings come tax season. In this comprehensive guide, we’ll delve […]

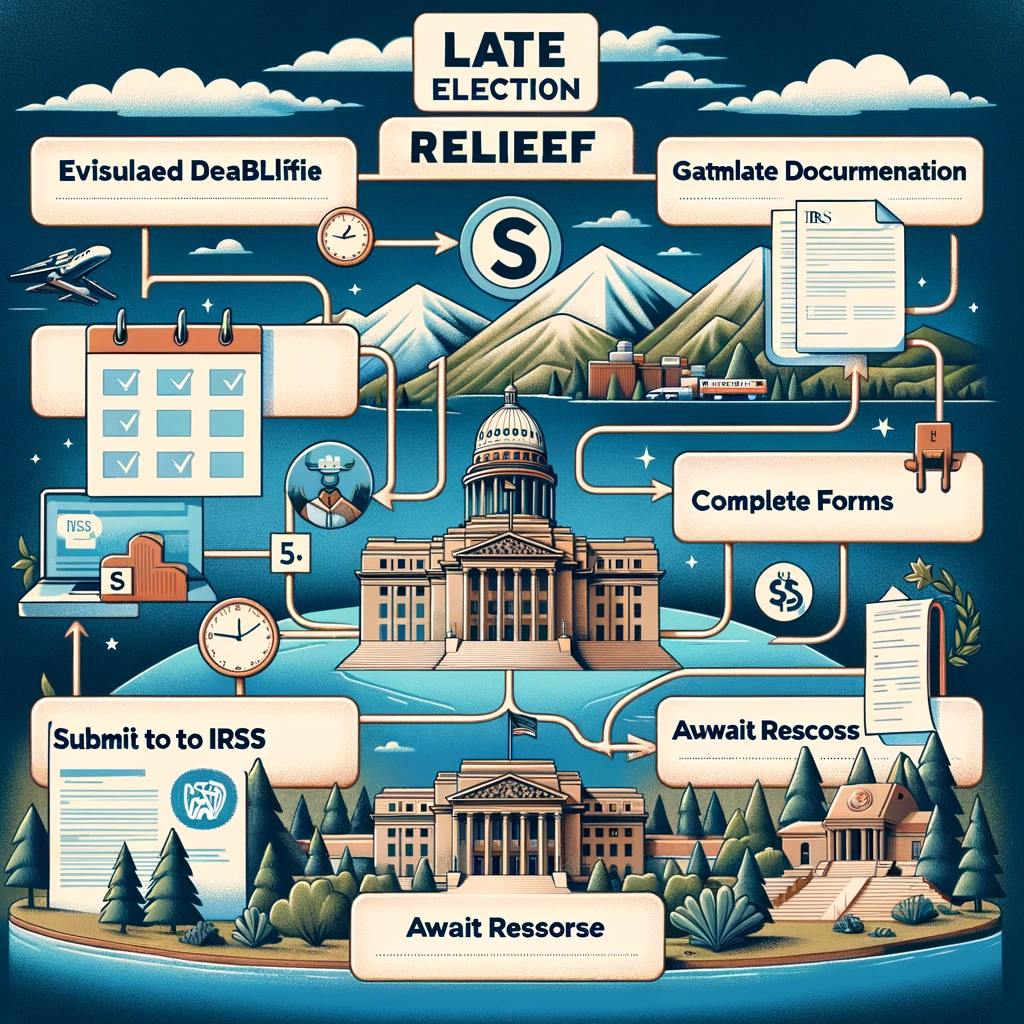

Late Election Relief for an S-Corporation in Idaho

Have you missed the deadline for electing S-Corporation status for your business in Idaho? Don’t fret; there might still be a ray of hope through late election relief. The IRS provides avenues for rectifying such oversights, but the process can be intricate. Let’s delve into what late election relief entails, how your S-Corporation in Idaho […]

Navigating the Path to Becoming a Qualified Real Estate Professional in Idaho

In the real estate industry, achieving the status of a “qualified real estate professional” can significantly enhance one’s financial prospects through substantial tax benefits. For those operating in Idaho, it’s essential to understand both the federal guidelines and the local nuances to fully leverage this advantageous status. Here, we’ll explore the comprehensive criteria and strategic […]