Understanding the Nexus for Income Tax: Rules and Regulations

Income tax is a critical aspect of fiscal policy and economic regulation. It funds essential public services such as healthcare, education, and infrastructure. The term “nexus” in the context of income tax refers to the connection or link that a state has with a business or individual that obligates them to pay taxes within that […]

Mid-Year Tax Planning in Idaho: Strategies to Maximize Your Tax Savings

As the calendar flips past the midway point of the year, Idaho taxpayers have a golden opportunity to assess their financial standing and explore avenues for minimizing their tax liabilities. With specific considerations unique to the Gem State, effective tax planning can lead to substantial savings come tax season. In this comprehensive guide, we’ll delve […]

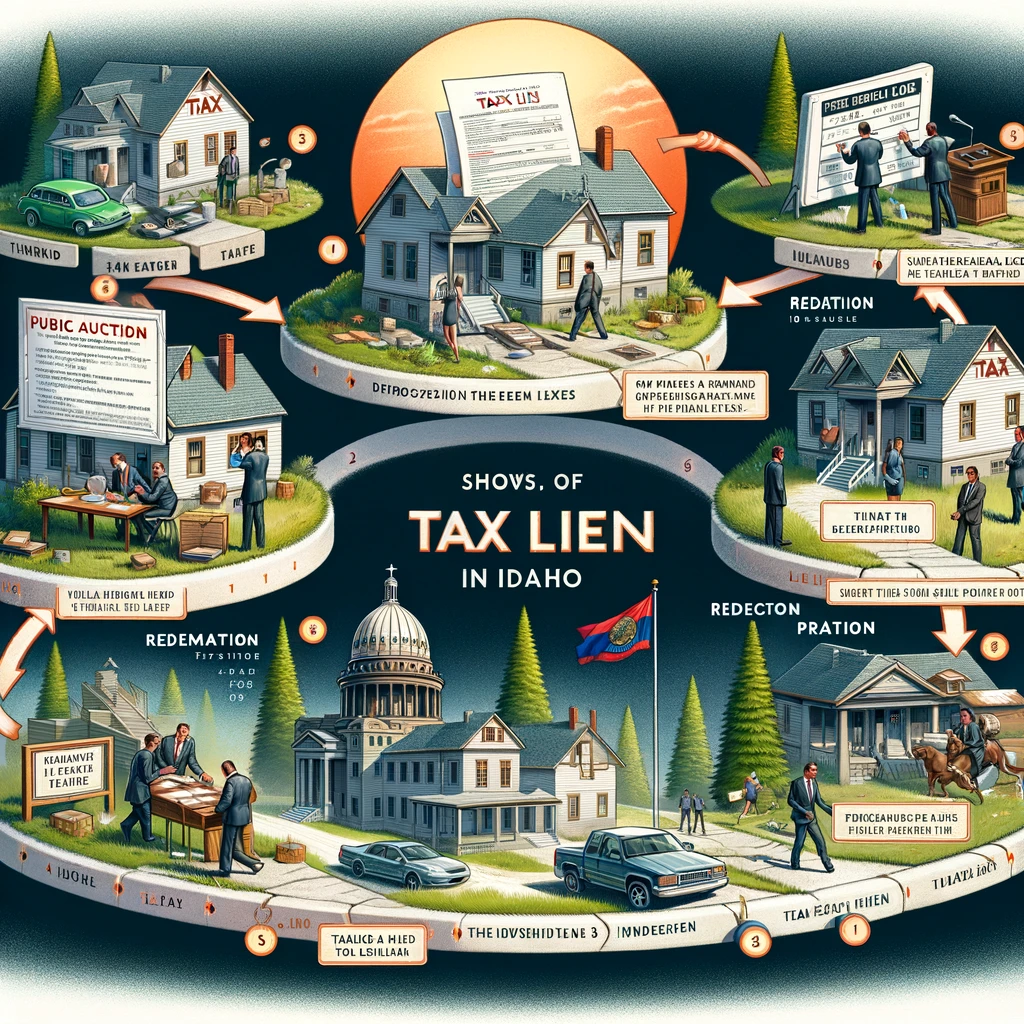

Understanding Tax Liens in Idaho: A Comprehensive Guide

Introduction In Idaho, as in other states, failing to pay taxes—whether property, income, or other forms—can trigger significant legal and financial consequences. The state employs tax liens as a mechanism to secure tax payments. This guide delves into the intricacies of tax liens, exploring their application across various types of taxes in Idaho, detailing the […]

Tax Deadline Passed: Facing Tax Debts to the IRS and Idaho

Tax season can be a source of significant stress, particularly for those who find themselves with a balance due to both the IRS and their state. For residents of Idaho, as in other states, it’s crucial to take proactive steps to manage and resolve tax liabilities effectively. This can help avoid the accrual of additional […]

Navigating the Complexities of Filing a Tax Extension in Idaho: A Comprehensive Guide

Tax season is a period marked by urgency and sometimes, anxiety for many taxpayers in Idaho. The rush to meet the April 15 deadline can be overwhelming, particularly for those dealing with complex tax situations or unexpected life events. Filing for a tax extension offers a solution, providing additional time to file your tax return […]

Currently Not Collectible as a Tax Resolution Option in Idaho

In-Depth Exploration of “Currently Not Collectible” Status “Currently Not Collectible” (CNC) status serves as a lifeline for taxpayers in Idaho and across the country who find themselves in dire financial straits, unable to settle their tax debts without compromising their ability to pay for basic living expenses. This comprehensive guide delves deeper into the nuances […]

Tax Efficient Investing in Idaho: Strategies for Maximizing Your Returns

Investing wisely not only involves choosing the right assets to grow your wealth but also understanding how to minimize the tax impact on your investments. For residents of Idaho, crafting a tax-efficient investment strategy can lead to significant savings and enhance the growth potential of your portfolio. This comprehensive guide will explore various strategies and […]

Common Tax Mistakes to Avoid for Idaho Taxpayers

Tax season often brings about a mix of emotions for individuals across the country, and Idaho residents are no exception. The complexities of tax laws, coupled with the fear of making mistakes, can make the process daunting. However, by understanding the common pitfalls, Idaho taxpayers can navigate the tax landscape with confidence and ensure compliance […]

The Taxpayer Bill of Rights

Taxpayers have the right to know what they need to do to comply with the tax laws. They are entitled to clear explanations of the laws and IRS procedures in all tax forms, instructions, publications, notices, and correspondence.