Introduction

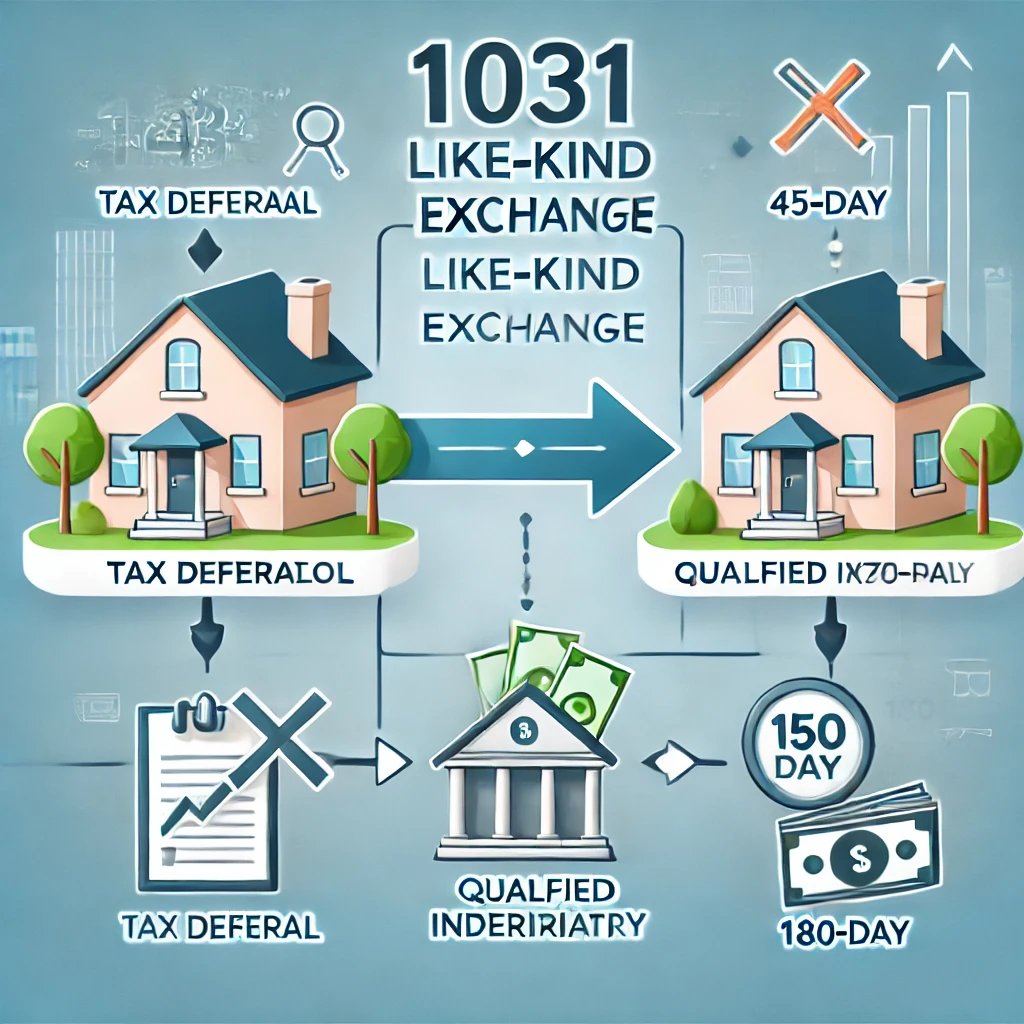

A like-kind exchange, also known as a 1031 exchange, is a powerful tool for real estate investors to defer capital gains taxes when selling an investment property. Named after Section 1031 of the Internal Revenue Code, this strategy allows investors to sell a property and reinvest the proceeds into a new, similar property, thereby deferring capital gains taxes. This blog will guide you through the steps and strategies to structure and execute a 1031 exchange for maximum tax savings.

Understanding Like-Kind Exchanges

What is a Like-Kind Exchange?

A like-kind exchange involves selling an investment property and purchasing another similar property while deferring the capital gains tax that would normally be incurred on the sale. The IRS allows this deferral to encourage reinvestment in similar properties, which can spur economic growth and property development.

Benefits of Like-Kind Exchanges

- Tax Deferral: The primary benefit is the deferral of capital gains taxes, which can be substantial, depending on the appreciation of the property being sold.

- Increased Buying Power: By deferring taxes, you can reinvest the full proceeds from the sale, giving you more buying power.

- Portfolio Diversification: You can use like-kind exchanges to diversify your investment portfolio by acquiring different types of properties.

- Estate Planning: 1031 exchanges can be part of a strategic estate planning tool, potentially allowing heirs to inherit properties with a stepped-up basis.

Steps to Structure a 1031 Exchange

1. Identify the Property to Exchange

The property you intend to sell, known as the relinquished property, must be held for productive use in a trade or business or for investment purposes. Personal residences or properties held primarily for resale do not qualify.

2. Engage a Qualified Intermediary (QI)

A key requirement for a 1031 exchange is the use of a Qualified Intermediary (QI). The QI facilitates the exchange by holding the proceeds from the sale of the relinquished property and then using those proceeds to purchase the replacement property. The IRS mandates the use of a QI to ensure the taxpayer does not take constructive receipt of the sale proceeds, which would disqualify the exchange.

3. Follow the 45-Day Identification Rule

You have 45 days from the sale of your relinquished property to identify potential replacement properties. This identification must be in writing, signed by you, and delivered to the QI. You can identify up to three properties regardless of their value or more if certain conditions are met (the 200% rule and the 95% rule).

4. Adhere to the 180-Day Purchase Rule

The replacement property must be purchased within 180 days from the sale of the relinquished property. This period includes the 45 days used to identify the replacement property. Timing is critical in 1031 exchanges, and missing these deadlines can disqualify the exchange.

5. Ensure the Same Taxpayer Rule

The taxpayer selling the relinquished property must be the same entity purchasing the replacement property. This rule ensures that the deferral benefits apply to the same taxpayer.

6. Proper Title Holding

The title to the new property must be held in the same manner as the title to the old property. For instance, if the relinquished property was held by a partnership, the replacement property must also be held by the same partnership.

Strategies for Maximum Tax Savings

1. Diversify Property Types

One of the advantages of a 1031 exchange is the ability to diversify your investment portfolio. You can exchange a commercial property for a residential rental property or vice versa. This strategy can help you shift into properties with better cash flow, appreciation potential, or lower management requirements.

2. Utilize Depreciation

Depreciation is a non-cash deduction that can offset taxable income. When you acquire a new property through a 1031 exchange, you can start a new depreciation schedule based on the cost of the replacement property. This can provide significant tax benefits, especially if the new property has a higher basis and thus more depreciation potential.

3. Defer Indefinitely

One powerful strategy is to continue executing 1031 exchanges with each subsequent property sale. By continually deferring capital gains taxes, you can effectively defer taxes indefinitely, maximizing the growth potential of your real estate investments.

4. Consider Delayed, Reverse, and Improvement Exchanges

- Delayed Exchange: The most common type of 1031 exchange, where the replacement property is acquired after the sale of the relinquished property.

- Reverse Exchange: This involves purchasing the replacement property before selling the relinquished property. This can be beneficial in hot markets where finding suitable replacement properties is challenging.

- Improvement Exchange: Also known as a construction or build-to-suit exchange, this allows you to use exchange funds to improve the replacement property.

5. Strategic Property Selection

Choosing properties in locations with strong appreciation potential or those that offer better rental income can enhance the benefits of a 1031 exchange. Researching market trends, economic indicators, and property performance metrics can help you make informed decisions.

6. Partner with Experts

Working with real estate professionals, tax advisors, and attorneys who specialize in 1031 exchanges can ensure compliance and help identify opportunities for maximizing benefits. These experts can provide valuable insights into market conditions, legal requirements, and strategic planning.

Important Considerations

Boot

Any cash or non-like-kind property received in the exchange is known as “boot.” Boot is taxable to the extent of the recognized gain. To avoid boot, ensure that the value of the replacement property is equal to or greater than the value of the relinquished property and that all proceeds are reinvested.

Depreciation Recapture

Depreciation recapture refers to the gain realized from the sale of depreciable real estate, which must be reported as income. While a 1031 exchange defers capital gains tax, it does not eliminate depreciation recapture tax, which will be due when the replacement property is eventually sold without further exchange.

Market Conditions

Market conditions can impact the success of a 1031 exchange. In a hot market, finding suitable replacement properties within the required timeframe can be challenging. Conversely, in a slow market, selling the relinquished property may take longer. Understanding market trends and planning accordingly can mitigate these risks.

Example of a Like-Kind Exchange

Consider an investor who owns a rental property valued at $500,000 with a $200,000 mortgage. The investor sells this property and identifies a new property worth $600,000 within the 45-day identification period. By using the proceeds from the sale, after paying off the mortgage, and adding additional funds, the investor purchases the new property within the 180-day period. This transaction defers the capital gains tax on the $300,000 profit from the sale, allowing the investor to reinvest the entire amount into the new property.

Conclusion

A like-kind exchange is a valuable tool for real estate investors seeking to defer capital gains taxes and maximize investment potential. By understanding the rules, adhering to the required timelines, and employing strategic planning, you can leverage 1031 exchanges to enhance your real estate portfolio. Always consult with qualified professionals to navigate the complexities of these transactions and to ensure compliance with IRS regulations. By doing so, you can achieve significant tax savings and bolster your long-term financial growth.