After a brief pause and much anticipation, the Financial Crimes Enforcement Network (FinCEN) Beneficial Ownership Information (BOI) reporting requirements are once again in effect. Businesses and entities across the U.S. must prepare to navigate these requirements to ensure compliance. Here’s what you need to know:

New Deadline Update

The reporting deadline for existing entities has been extended to January 13, 2025, due to recent court rulings.

Court of Appeals Ruling

Initially, a judge in Texas ruled BOI reporting unconstitutional, leading to a temporary suspension. However, the Court of Appeals reversed the decision, reinstating the requirement. Businesses are now obligated to meet the updated deadlines and requirements. The Court also clarified that entities claiming exemptions must explicitly document and substantiate their status. Failure to do so may result in penalties or revocation of the exemption. Businesses are encouraged to carefully review their eligibility and compliance strategies.

Non-compliance carries significant consequences, including fines of up to $500 per day and potential criminal penalties.

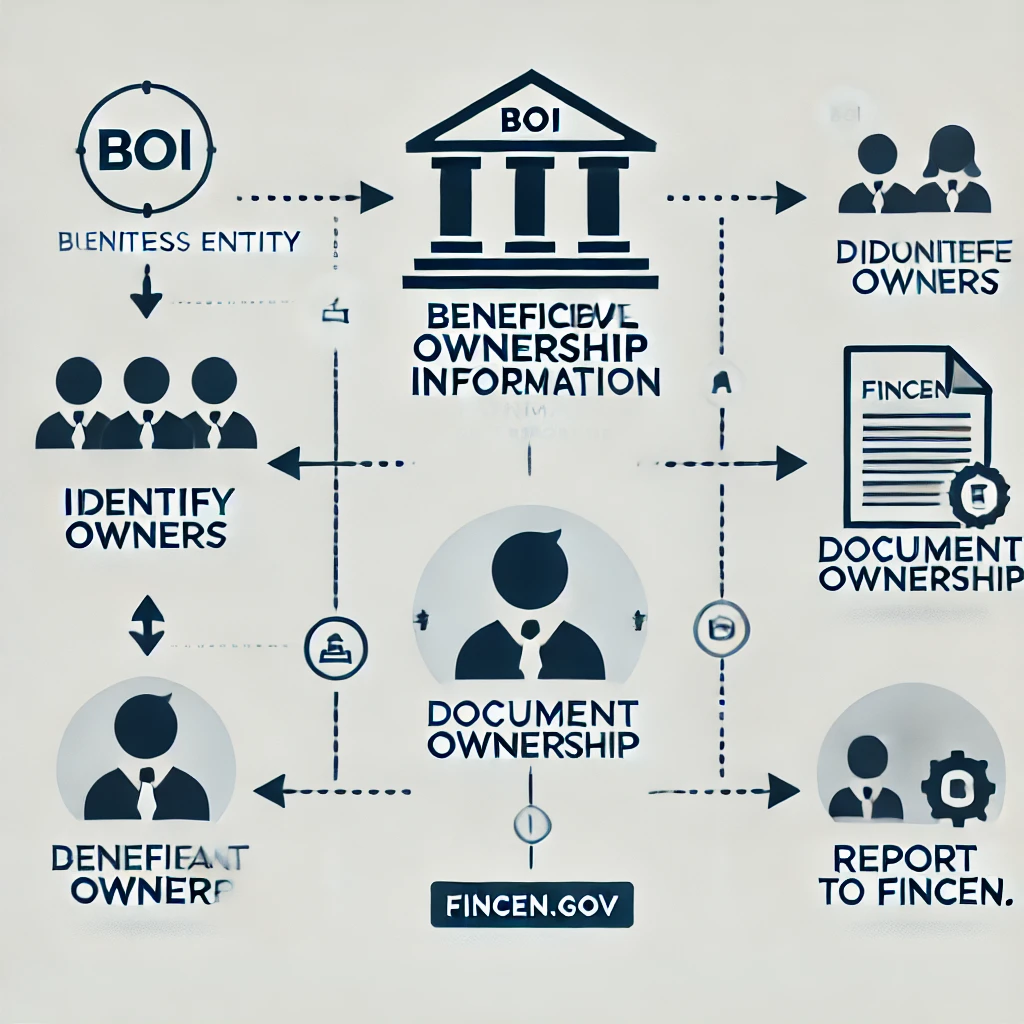

What is FinCEN BOI Reporting?

The BOI reporting requirement, part of the Corporate Transparency Act (CTA), aims to prevent illicit activities like money laundering and terrorism financing. Certain entities must disclose information about their beneficial owners — individuals who own or control at least 25% of the entity or have substantial managerial authority.

Who is Required to Report?

Beginning January 1, 2024, the BOI reporting mandate applies to:

- Corporations

- Limited Liability Companies (LLCs)

- Other similar entities created or registered to do business in the U.S.

Certain entities, such as publicly traded companies and heavily regulated institutions (e.g., banks and insurance companies), are exempt.

Key Details to Report

Entities required to file must provide:

- Name, date of birth, address, and identification number of each beneficial owner.

- Information about individuals forming the entity (company applicants) for entities created after January 1, 2024.

Timeline and Penalties

Deadlines for compliance include:

- Existing entities: File by January 13, 2025.

- New entities: File within 30 days of formation.

Why This Matters

The BOI reporting requirement supports a more transparent and secure financial ecosystem. For businesses, it introduces an additional layer of regulatory compliance that demands attention to detail and timely action.

Steps to Prepare

To ensure compliance:

- Identify Beneficial Owners: Determine who meets the ownership or control criteria.

- Gather Required Information: Collect all necessary details for reportable individuals.

- Update Governance Documents: Ensure records accurately reflect ownership and control structures.

- Consult a Professional: Engage a CPA or legal advisor experienced with BOI requirements to guide the process.

Looking Ahead

While compliance may seem burdensome, it is a critical step in fostering trust and security in the financial system. Acting promptly can help businesses avoid penalties and streamline the reporting process.

At Idaho Tax and Bookkeeping Services LLC, we’re committed to helping you navigate these requirements. Whether you need assistance with compliance or have questions about your reporting obligations, our experienced professionals are here to support you.

Don’t wait until the deadline — start preparing today!