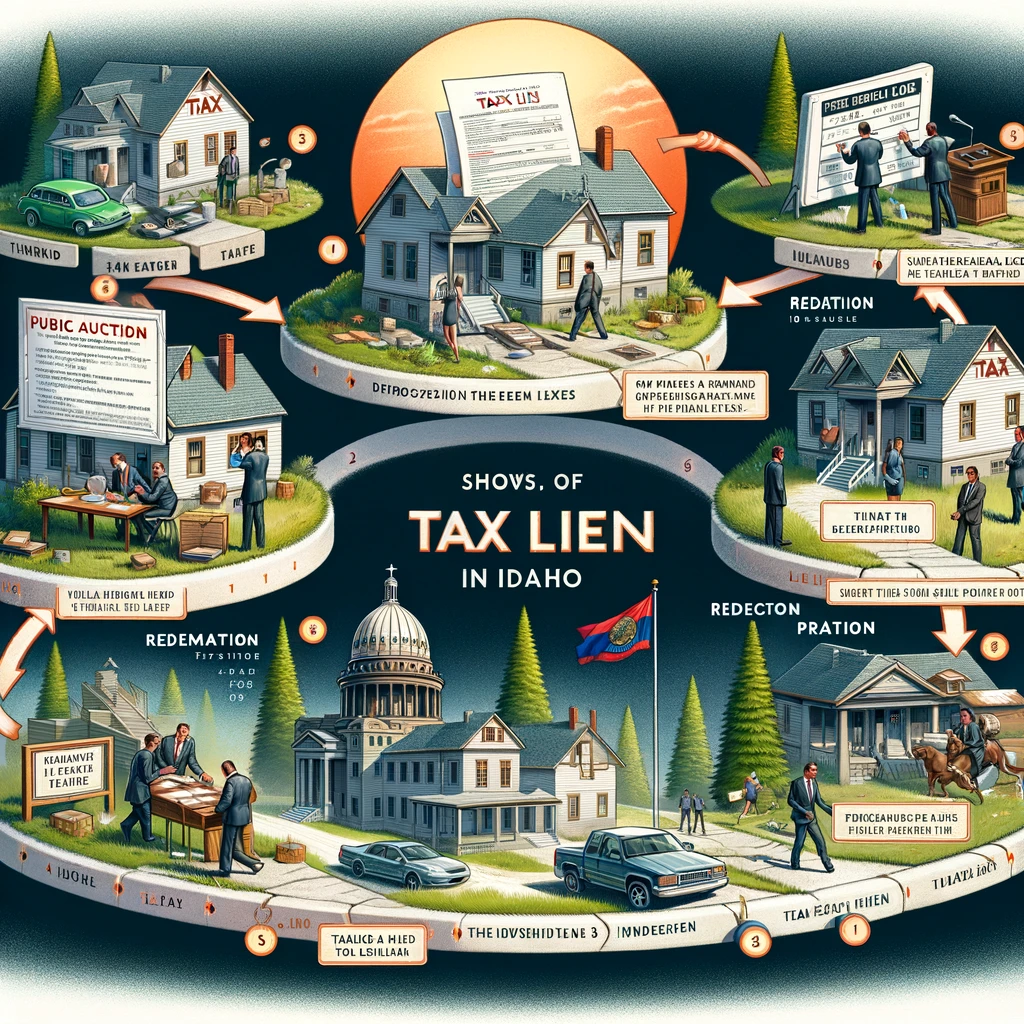

Understanding Tax Liens in Idaho: A Comprehensive Guide

Introduction In Idaho, as in other states, failing to pay taxes—whether property, income, or other forms—can trigger significant legal and financial consequences. The state employs tax liens as a mechanism to secure tax payments. This guide delves into the intricacies of tax liens, exploring their application across various types of taxes in Idaho, detailing the […]

Understanding IRS CP2000 Letters: Navigating IRS Correspondence with Confidence

Picture this: you return home after a long day, only to find an official-looking envelope waiting for you. Your heart skips a beat as you recognize the sender – the Internal Revenue Service (IRS). You open the envelope to reveal a CP2000 notice, and suddenly, the familiar dread of tax season takes on a new […]

Tax Deadline Passed: Facing Tax Debts to the IRS and Idaho

Tax season can be a source of significant stress, particularly for those who find themselves with a balance due to both the IRS and their state. For residents of Idaho, as in other states, it’s crucial to take proactive steps to manage and resolve tax liabilities effectively. This can help avoid the accrual of additional […]

Navigating the Complexities of Filing a Tax Extension in Idaho: A Comprehensive Guide

Tax season is a period marked by urgency and sometimes, anxiety for many taxpayers in Idaho. The rush to meet the April 15 deadline can be overwhelming, particularly for those dealing with complex tax situations or unexpected life events. Filing for a tax extension offers a solution, providing additional time to file your tax return […]

Currently Not Collectible as a Tax Resolution Option in Idaho

In-Depth Exploration of “Currently Not Collectible” Status “Currently Not Collectible” (CNC) status serves as a lifeline for taxpayers in Idaho and across the country who find themselves in dire financial straits, unable to settle their tax debts without compromising their ability to pay for basic living expenses. This comprehensive guide delves deeper into the nuances […]

How to Handle an IRS Audit: Expert Tips for Taxpayers

Receiving a notice of an IRS audit can trigger feelings of uncertainty and anxiety for any taxpayer. However, with the right approach and preparation, navigating through the audit process can be manageable and less intimidating. In this comprehensive guide, we’ll delve into invaluable tips from tax professionals to help you handle an IRS audit with […]

IRS Notices and Correspondence: Navigating Through the Maze

Dealing with the Internal Revenue Service (IRS) can often feel overwhelming, especially when you receive an unexpected notice or piece of correspondence in the mail. These communications can range from simple notifications to requests for additional information, audits, or notifications of due taxes. Understanding the different types of notices and how to respond to […]

Tax Efficient Investing in Idaho: Strategies for Maximizing Your Returns

Investing wisely not only involves choosing the right assets to grow your wealth but also understanding how to minimize the tax impact on your investments. For residents of Idaho, crafting a tax-efficient investment strategy can lead to significant savings and enhance the growth potential of your portfolio. This comprehensive guide will explore various strategies and […]

Common Tax Mistakes to Avoid for Idaho Taxpayers

Tax season often brings about a mix of emotions for individuals across the country, and Idaho residents are no exception. The complexities of tax laws, coupled with the fear of making mistakes, can make the process daunting. However, by understanding the common pitfalls, Idaho taxpayers can navigate the tax landscape with confidence and ensure compliance […]

Utilizing Idaho’s Pass-Through Entity Tax Election

Navigating the complexities of business taxes can often feel like trying to solve a puzzle with constantly changing pieces. For business owners in Idaho, the pass-through entity tax election represents a crucial piece of this puzzle, offering a strategic advantage under certain conditions. This guide aims to demystify this option, providing a comprehensive understanding suitable […]