Idaho Tax Credits: What You Need to Know

As an Idaho resident or business owner, understanding the various tax credits available can have a significant impact on your financial situation. Tax credits can reduce your overall tax liability, putting more money back into your pocket. In this comprehensive guide, we will explore some of the key tax credits offered in the Gem State […]

S Corp vs. LLC in Idaho: Reporting, Taxation, and Officer Compensation Explained

So, you’re thinking about starting a business in Idaho, and you’ve come across two popular options: the S Corporation (S Corp) and the Limited Liability Company (LLC). But what sets these two business structures apart, especially when it comes to reporting, taxation, and officer compensation? Let’s break it down in simple terms. Business Structure Basics: […]

Federal vs. Idaho State Taxes: A Guide for the Everyday Taxpayer

Taxes are an inevitable part of life, and understanding them is crucial for every taxpayer. In the United States, the tax system operates on both federal and state levels, each with its own set of rules and regulations. For residents of Idaho, navigating the nuances of both federal and state taxes is essential for financial […]

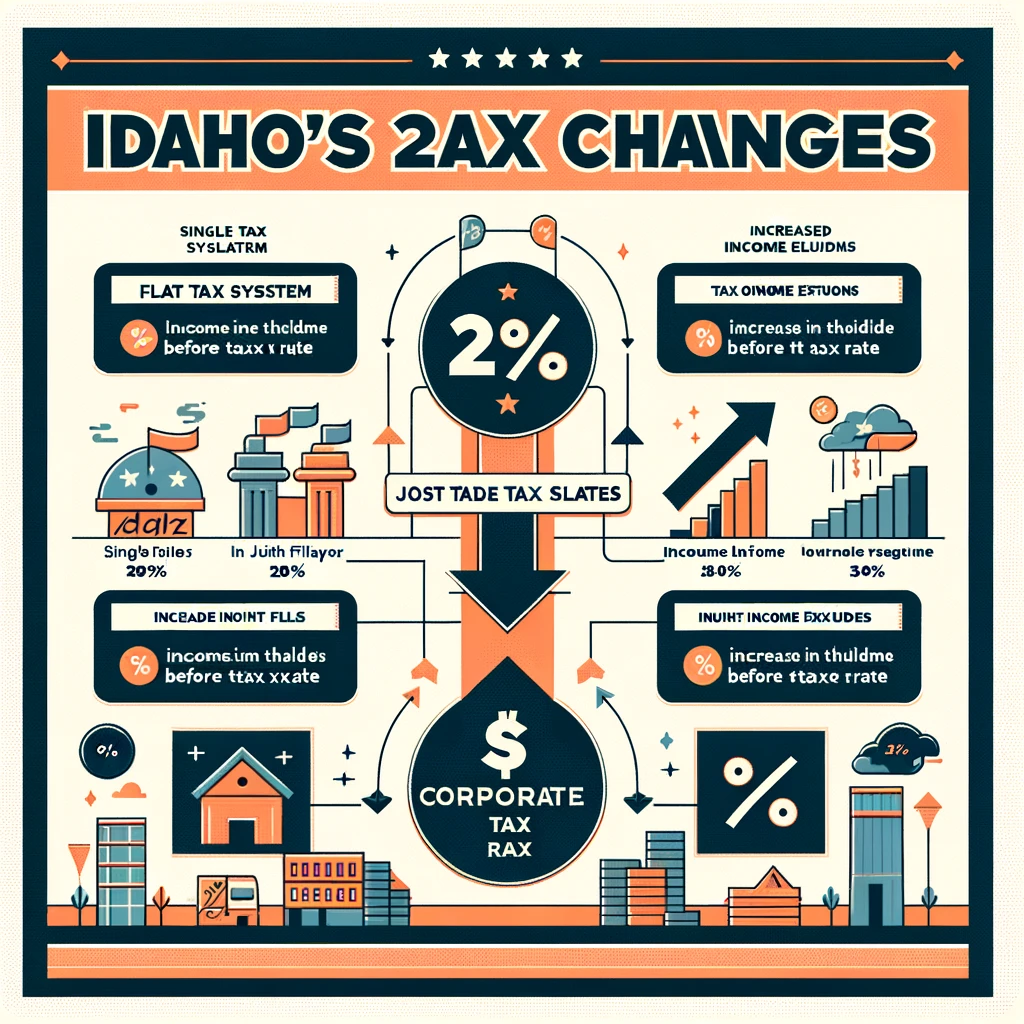

A Closer Look at Idaho’s Tax System Changes in 2024

In 2024, Idaho introduced some major changes to its tax system, and understanding these changes can be really interesting, especially for 9th graders learning about how taxes work. Let’s explore these changes in a way that’s easy to understand and dig into why they matter. Idaho’s Big Tax Change: The Flat Tax System 1. What […]

Understanding and Managing Business Expenses in Idaho

Navigating the complex world of business expenses is a critical task for entrepreneurs. The ability to effectively manage these costs can be the difference between a thriving business and one that struggles to stay afloat. In this comprehensive guide, we’ll explore the intricacies of business expenses, their importance, and effective strategies for managing them. Our […]

IRS Fresh Start Program in Idaho

Introduction Tax debts can be a significant source of stress, particularly in Idaho, where many feel overwhelmed by this financial burden. However, the IRS Fresh Start Program emerges as a beacon of hope, offering manageable solutions and relief for those grappling with tax debts. This comprehensive blog post aims to shed light on the Fresh […]

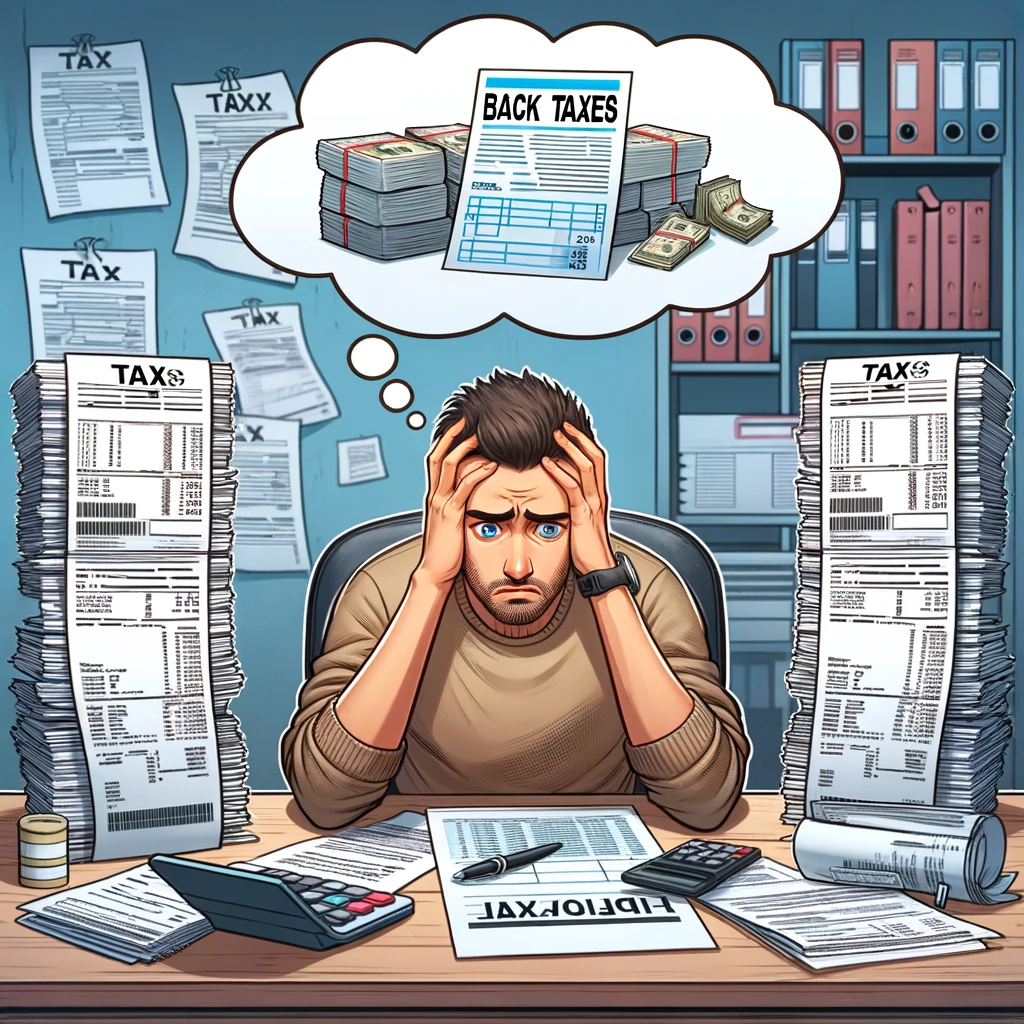

Navigating the Maze: A Comprehensive Guide to Dealing with IRS Back Taxes

Introduction: Dealing with IRS back taxes can be a challenging and overwhelming experience. Whether you’ve recently discovered an outstanding tax liability or have been dealing with it for some time, understanding the various aspects of the process is crucial. In this comprehensive guide, we’ll delve into the intricacies of handling IRS back taxes, exploring the […]

Navigating an Idaho State Tax Commission Audit: What You Need to Know

Understanding Tax Audits in Idaho When you hear about an audit from the Idaho State Tax Commission, it can seem really scary. It’s normal to feel worried, especially if you’re not sure about tax rules or if you think it might lead to money problems. But understanding what an audit is and how it works […]

IRS Offer in Compromise in Idaho: A Comprehensive Guide with Ilir Nina CPA, EA, MSAT

Understanding IRS Offer in Compromise in Idaho Dealing with IRS tax debt can be an overwhelming experience, and for individuals and businesses in Idaho, understanding the potential solution of an Offer in Compromise (OIC) is crucial. In this extensive guide, we’ll explore the ins and outs of the IRS Offer in Compromise program, shedding light […]

Business Taxes in Idaho: A Strategic Guide for Success

Running a business in Idaho comes with its unique set of challenges and opportunities, especially when it comes to taxes. In this comprehensive blog, we’ll explore essential aspects of business taxes in Idaho, emphasizing the importance of tax planning, various business structures, deductions, and the significance of meticulous record-keeping. I. The Role of Tax Planning […]