Introduction

In Idaho, as in other states, failing to pay taxes—whether property, income, or other forms—can trigger significant legal and financial consequences. The state employs tax liens as a mechanism to secure tax payments. This guide delves into the intricacies of tax liens, exploring their application across various types of taxes in Idaho, detailing the process, implications for taxpayers, and opportunities for investors.

What is a Tax Lien?

A tax lien represents a legal claim or hold placed by a tax authority against the assets of an individual or business for failing to pay owed taxes. This can include liens against property, financial assets, and other personal assets. The lien ensures that taxes are paid before other debts whenever the assets are sold or refinanced.

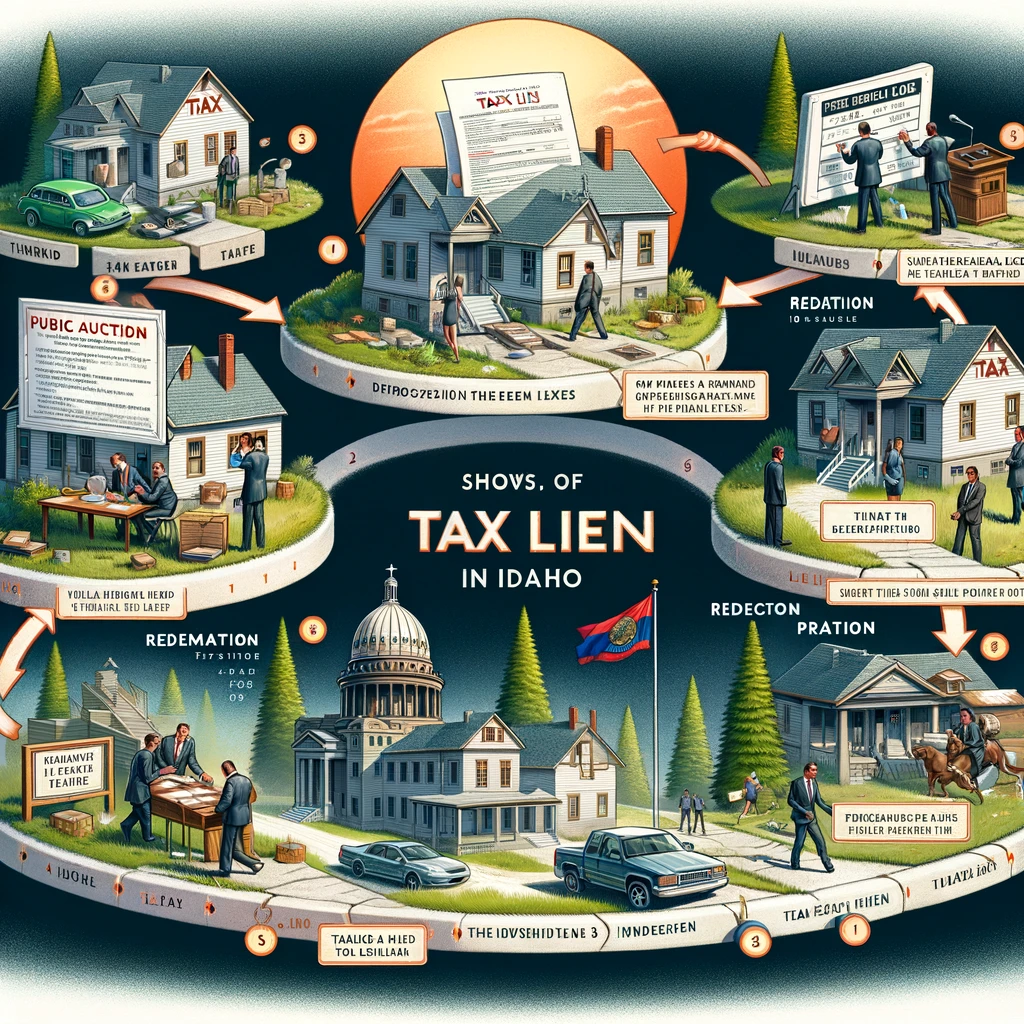

How Tax Liens Work in Idaho

The imposition and enforcement of tax liens in Idaho follow a systematic process designed to ensure fair collection practices while providing taxpayers ample opportunity to fulfill their obligations:

Notification

The journey of a tax lien begins when the taxpayer receives a formal notification from the tax authority. This notice specifies the amount of tax due and the deadline for payment. It serves both to inform the taxpayer of their delinquent status and to initiate the lien process should payments not be made in time.

Tax Lien Imposition

If the taxpayer fails to clear their dues by the deadline, Idaho imposes a tax lien on their assets. This lien applies broadly, encompassing all types of personal and real property.

Public Record

Once imposed, the tax lien becomes a public record, potentially affecting the taxpayer’s credit score and hindering their ability to engage in future financial transactions involving their assets.

Tax Lien Sale

For significant tax debts, the state may auction these liens to investors. These sales are typically held publicly and offer investors the chance to purchase the debt at competitive rates, starting with the owed tax amount plus any additional fees and accrued interest.

Redemption Period

Post-sale, the original taxpayer has a designated redemption period to repay the full debt amount plus interest to the investor holding the lien. This period is critical as it allows taxpayers a final opportunity to retain ownership of their assets by settling their debts.

Foreclosure

Failure to redeem the tax lien within the allotted timeframe empowers the lienholder to initiate foreclosure proceedings. This process can culminate in the taxpayer losing ownership of their assets if they are unable to settle their outstanding debts.

Implications for Taxpayers

Tax liens can substantially disrupt a taxpayer’s financial health. The implications extend beyond simple asset encumbrance; they can affect credit ratings, hinder asset liquidity, and lead to increased financial burdens through accruing interest and penalties. Taxpayers facing liens must consider various strategies, such as payment plans, to mitigate these impacts. Engaging with tax professionals can provide guidance through this complex landscape, helping to negotiate with tax authorities or explore relief options that may be available.

Implications for Investors

For investors, tax liens represent an appealing investment due to the high interest rates and security provided by the underlying assets. However, the investment is not without its risks. The possibility of taxpayer redemption means the anticipated high returns might not materialize if the debt is settled within the redemption period. Furthermore, the foreclosure process can be lengthy and legally intensive, requiring a robust understanding of legal procedures and potential court battles.

Investors need to thoroughly evaluate each tax lien opportunity, examining the taxpayer’s financial stability, the asset’s value, and the overarching legal framework. This due diligence is crucial in mitigating risks associated with such investments.

Conclusion

Tax liens in Idaho serve as a vital enforcement mechanism for tax collection, ensuring that the government collects the necessary revenue to fund public services. For taxpayers, they pose significant risks that require immediate and informed responses to avoid severe financial repercussions. For investors, while offering potentially high returns, tax liens necessitate careful consideration and understanding of the associated legal and financial landscapes.

Understanding tax liens, their implications, and the strategies to manage them is essential for both taxpayers and investors. Consulting with financial advisors and legal experts is advisable to navigate these complex issues effectively. As tax laws and procedures can evolve, staying informed and proactive is crucial in managing or investing in tax liens.