Introduction

In his new term, President Donald Trump has introduced a series of tax reform proposals designed to provide financial relief to various groups, promote economic growth, and address inequities within the tax system. These proposals span several areas, including Social Security taxes, income tax reforms, the State and Local Tax (SALT) deduction, the carried interest issue, and the extension of provisions under the 2017 Tax Cuts and Jobs Act (TCJA).

This blog explores these tax proposals in detail and analyzes their likelihood of passing, given the current political environment where Republicans control both the House and Senate. The outcome of these reforms will have a significant impact on millions of Americans and the overall federal budget.

Eliminating Taxes on Social Security Benefits

One of Donald Trump’s key proposals is the elimination of federal income taxes on Social Security benefits. Currently, Social Security benefits are subject to federal income taxes if recipients’ total combined income exceeds certain thresholds. Depending on their income levels, retirees can be taxed on up to 85% of their Social Security benefits.

The idea behind eliminating this tax is to enhance financial security for retirees by increasing their disposable income. Many retirees, especially those on fixed incomes, have struggled under the current tax structure, and this proposal is intended to ease their financial burden.

However, critics argue that eliminating taxes on Social Security benefits would significantly reduce federal revenue. Estimates suggest this change could cost between $550 billion and $1.5 trillion over ten years. The challenge for lawmakers will be to offset this revenue loss without increasing the deficit or cutting funding for other vital programs.

Exempting Tips and Overtime Pay from Income Tax

Another notable proposal is to exempt tips and overtime pay from federal income taxes. Workers in the hospitality, retail, and service industries often rely on tips and overtime to make a living wage. By exempting these earnings from taxation, President Trump aims to provide greater take-home pay to these workers.

This proposal, if implemented, would also result in a significant reduction in federal revenue. Estimates range from $100 billion to $550 billion over ten years for tip exemptions and from $250 billion to $3 trillion over ten years for exempting overtime pay. Despite these concerns, proponents argue that this change would help support working-class Americans and stimulate consumer spending, which could ultimately benefit the economy.

Modifying the State and Local Tax (SALT) Deduction Cap

The 2017 TCJA introduced a $10,000 cap on the SALT deduction, which has been a source of frustration for taxpayers in high-tax states such as California, New York, and New Jersey. Before the cap, taxpayers were allowed to deduct the full amount of state and local property, income, and sales taxes from their federal taxable income.

President Trump has expressed a willingness to modify this cap by potentially doubling it to $20,000. This adjustment would provide relief to residents of high-tax states while maintaining some level of limitation to prevent excessive deductions by high-income taxpayers.

Doubling the SALT deduction cap is estimated to cost approximately $160 billion over ten years. Alternatively, raising the cap exclusively for middle- and working-class earners could reduce the cost to about $107 billion. Supporters believe this change would address concerns about fairness and regional disparities in the tax code, while opponents argue it primarily benefits wealthier taxpayers.

Closing the Carried Interest Loophole

The carried interest loophole has long been a target of tax reform advocates. This provision allows private equity and hedge fund managers to pay taxes on their earnings at the lower capital gains rate rather than the higher ordinary income rate. Critics argue that this loophole unfairly benefits wealthy investors at the expense of ordinary taxpayers.

President Trump has renewed his commitment to closing the carried interest loophole, which would ensure that financial sector professionals pay taxes on their income at the same rates as other high-income earners. Eliminating this loophole is projected to generate approximately $1.5 billion in additional federal revenue annually. However, opposition from the financial industry and certain lawmakers could pose challenges to the passage of this reform.

Extending the 2017 Tax Cuts and Jobs Act (TCJA)

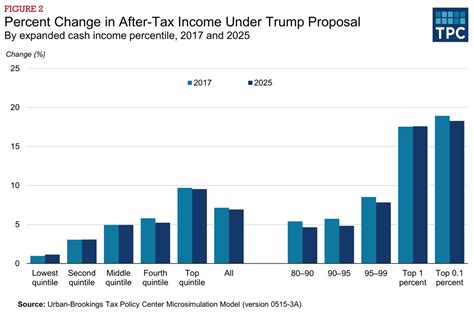

The TCJA, enacted in 2017, introduced significant tax cuts for both individuals and businesses. Many of these provisions, including lower individual tax rates, are set to expire at the end of 2025. President Trump has made it a priority to extend these tax cuts to maintain lower tax rates and continue supporting economic growth.

Extending the TCJA is estimated to reduce federal revenue by $3.9 trillion to $4.8 trillion over ten years. Supporters argue that the extension is necessary to prevent a tax increase on millions of Americans and to provide stability for businesses. Opponents, however, express concerns about the impact on the federal deficit and the distribution of benefits, with some arguing that the tax cuts disproportionately favor high-income earners and large corporations.

Additional Proposals

In addition to the major initiatives outlined above, President Trump’s administration is considering several other tax reforms, including:

- Creating Tax Incentives for Domestic Production: To encourage businesses to manufacture goods in the United States, the administration is exploring tax incentives for domestically produced goods.

- Eliminating Tax Breaks for Billionaire Sports Team Owners: This proposal aims to address perceived inequities in the tax code by eliminating tax breaks for billionaire sports team owners and other wealthy individuals who benefit from special provisions.

- Simplifying the Tax Code: Streamlining the tax code to reduce complexity and improve compliance is another potential area of focus for the administration.

These proposals reflect the administration’s broader goal of promoting economic growth and addressing perceived unfairness in the tax system.

Likelihood of Passage

The likelihood of President Trump’s tax proposals being enacted depends largely on the current balance of power in Congress. With Republicans holding narrow majorities in both the House and Senate, the passage of these proposals is plausible but not guaranteed.

The budget reconciliation process, which allows for expedited consideration of certain tax and spending legislation, may be employed to pass these measures with a simple majority in the Senate. However, the slim margins mean that internal party unity is crucial. Any dissent from moderate or fiscally conservative Republicans could jeopardize the legislative agenda.

Additionally, concerns about the federal deficit will play a significant role in the debate. Critics of the proposals argue that they could significantly increase the national debt, while supporters contend that the economic growth generated by the tax cuts will offset the revenue losses.

Conclusion

President Trump’s proposed tax reforms represent a comprehensive effort to reshape the federal tax landscape. From eliminating taxes on Social Security benefits to modifying the SALT deduction cap and closing the carried interest loophole, these proposals aim to provide relief to various groups and stimulate economic growth.

However, the passage of these reforms is not guaranteed. With Republicans holding narrow majorities in both chambers of Congress, achieving consensus within the party will be essential. The budget reconciliation process may provide a path forward, but concerns about the federal deficit and the distribution of benefits will likely shape the debate.

As the legislative process unfolds, it will be important for taxpayers, businesses, and policymakers to stay informed about these proposals and their potential impact on the economy and federal budget. The outcome of these reforms will have significant implications for millions of Americans and the future of the U.S. tax system.

References

- Committee for a Responsible Federal Budget. (2024). Trump’s tax priorities total $5-11 trillion. Retrieved from https://www.crfb.org

- MarketWatch. (2025). Trump could stick it to Wall Street and Silicon Valley with this tax proposal. Retrieved from https://www.marketwatch.com

- New York Post. (2025). Trump asks GOP leaders to end tax perks for billionaire sports owners. Retrieved from https://nypost.com

- Plante Moran. (2025). Tax policy perspectives: January 2025. Retrieved from https://www.plantemoran.com

- Politico. (2025). House GOP still has big problems to solve on its budget. Retrieved from https://www.politico.com

- Reuters. (2025). Republicans say they are nearing deal on Trump’s tax cuts, divided on cost. Retrieved from https://www.reuters.com