The Importance of Tax Planning: How Smart Decisions Before Year End Can Save You Thousands

Tax planning is one of the most powerful financial tools available to individuals and businesses.

Tax planning is one of the most powerful financial tools available to individuals and businesses.

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) became law, reshaping how

By Ilir Nina, CPA | Idaho Tax & Bookkeeping Services If you’re living in Idaho

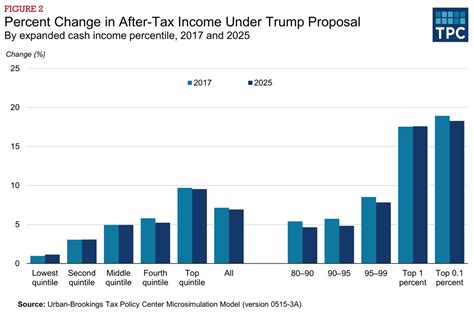

Introduction In his new term, President Donald Trump has introduced a series of tax reform

Ilir Nina CPA, EA,MSAT January marks the beginning of tax season—a time when individuals and

Tax season may seem like a time of stress and deadlines, but it doesn’t have

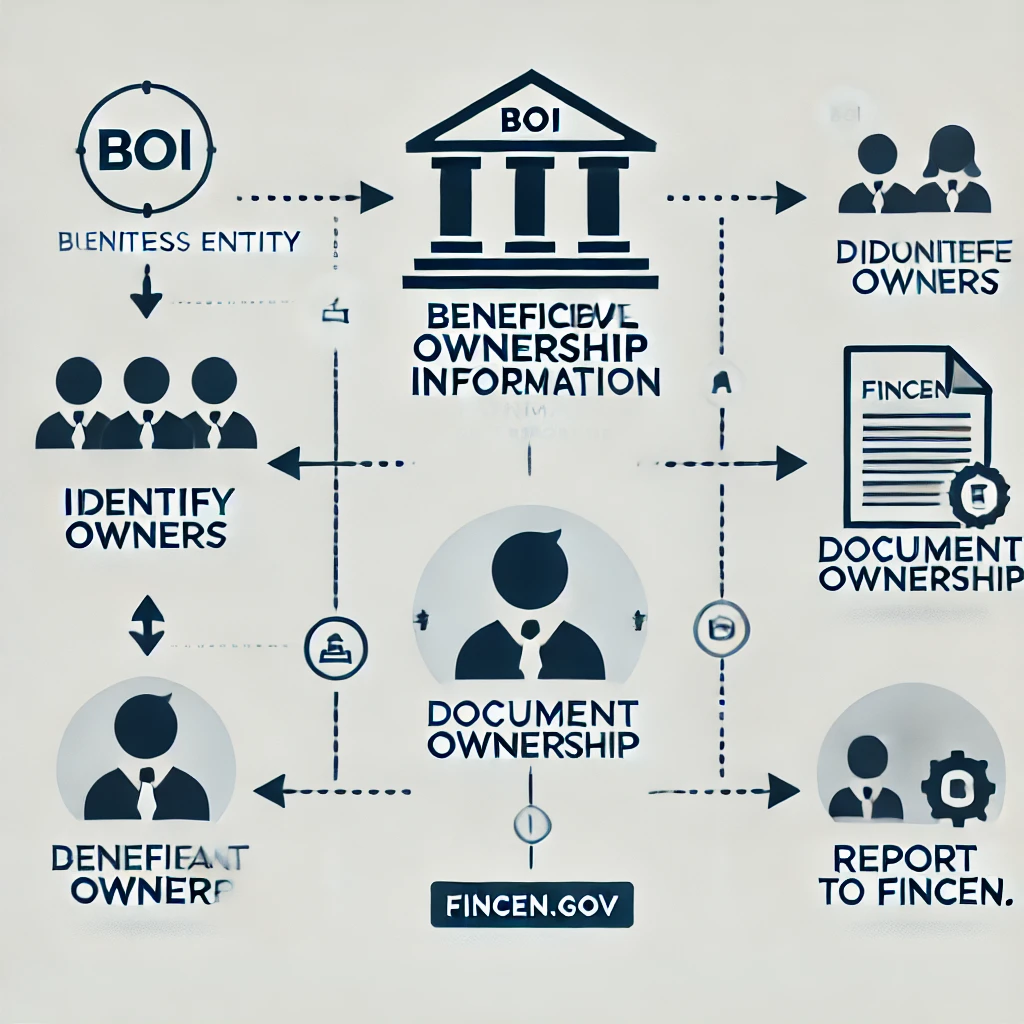

After a brief pause and much anticipation, the Financial Crimes Enforcement Network (FinCEN) Beneficial Ownership

Cryptocurrency has emerged as a revolutionary financial asset, captivating investors, tech enthusiasts, and even skeptics

The holiday season is a time of joy, celebration, and giving—but it can also be

When dealing with unpaid taxes, either at the federal or state level, you may encounter

With the possibility of Donald Trump returning to the presidency, many wonder how his administration’s

As 2025 approaches, Idaho small business owners have a critical opportunity to review their tax

As the year draws to a close, many individuals and business owners start to think

As the year draws to a close, many Idaho residents are thinking about preparing for

As the year draws to a close, the significance of tax planning for both individuals

In recent years, cryptocurrency has taken the world by storm, offering exciting investment opportunities for

In today’s fast-paced business environment, staying on top of tax deadlines is critical to maintaining

Sales tax audits can be a daunting experience for both businesses and the tax professionals

Filing taxes can be a complex process, especially when it involves estates and trusts. In

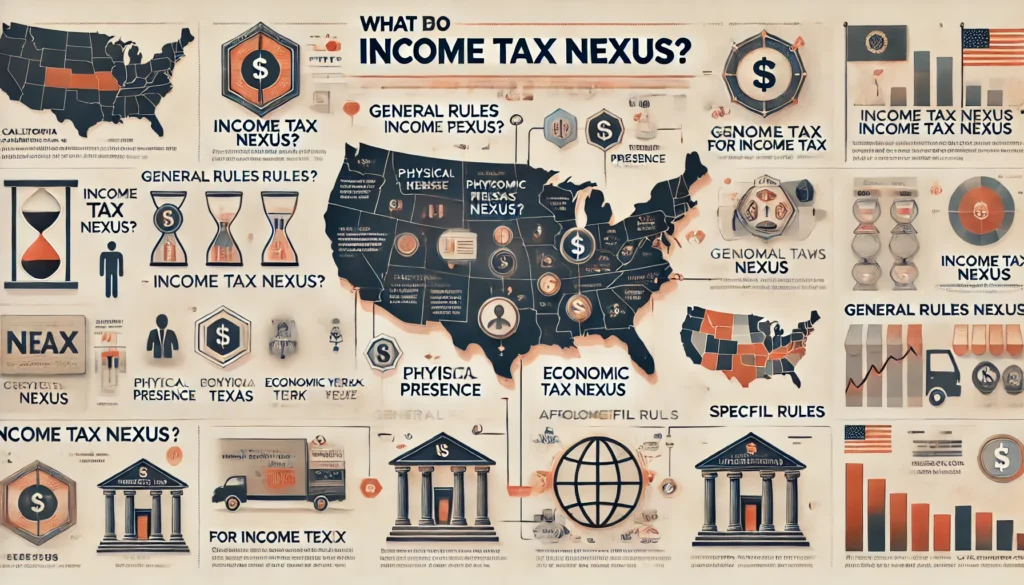

Income tax is a critical aspect of fiscal policy and economic regulation. It funds essential

Introduction A like-kind exchange, also known as a 1031 exchange, is a powerful tool for

Tax Breaks for Higher Education Expenses in Idaho Higher education can be a significant financial

Renting out a vacation home can be a rewarding and profitable endeavor. However, navigating the

In the business world, vehicles play a crucial role in day-to-day operations, from delivering products

Introduction As the owner of an S-corporation, determining your compensation can be a complex and

Tax audits can be a daunting prospect for any taxpayer. Understanding what might trigger an

As the calendar flips past the midway point of the year, Idaho taxpayers have a

Have you missed the deadline for electing S-Corporation status for your business in Idaho? Don’t

Curabitur non nulla sit amet nisl tempus convallis quis ac lectus.