Navigating the Path to Becoming a Qualified Real Estate Professional in Idaho

In the real estate industry, achieving the status of a “qualified real estate professional” can

In the real estate industry, achieving the status of a “qualified real estate professional” can

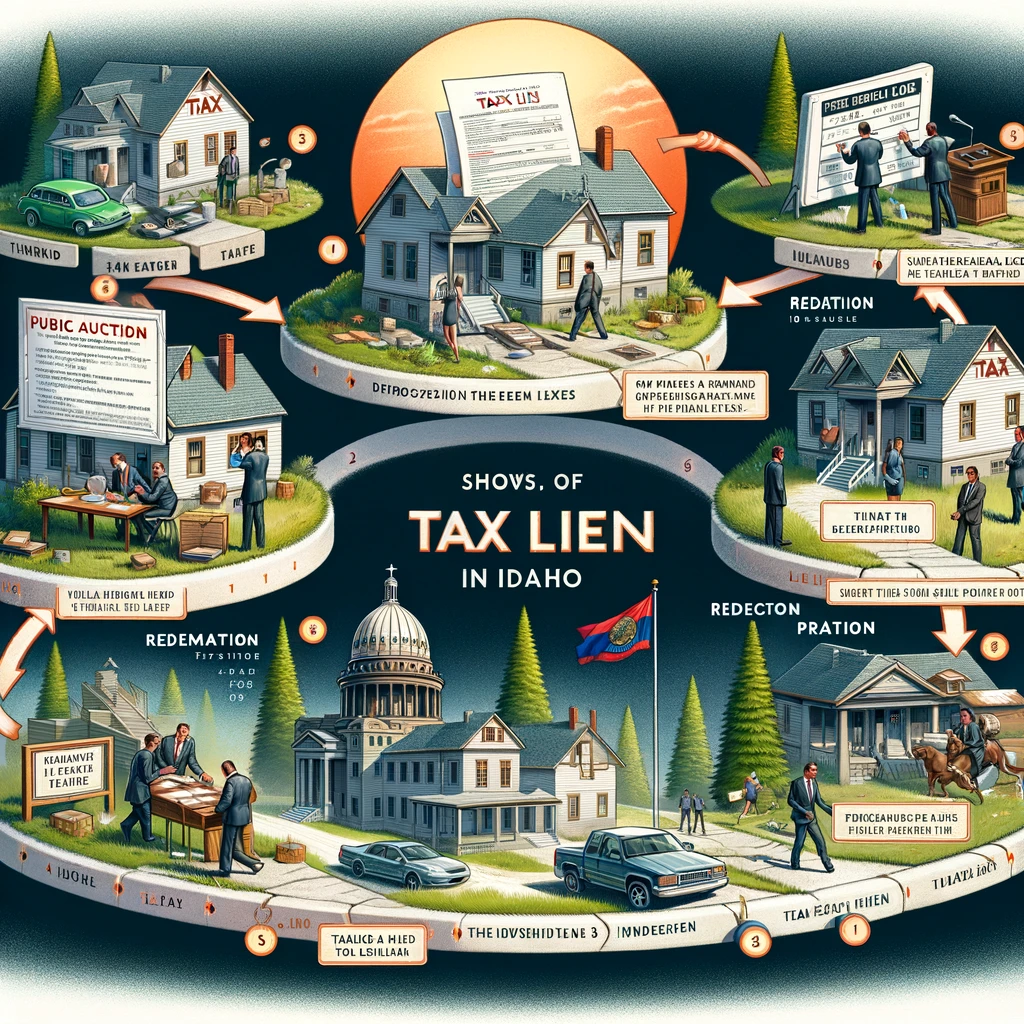

Introduction In Idaho, as in other states, failing to pay taxes—whether property, income, or other

Picture this: you return home after a long day, only to find an official-looking envelope

Tax season can be a source of significant stress, particularly for those who find themselves

Tax season is a period marked by urgency and sometimes, anxiety for many taxpayers in

In-Depth Exploration of “Currently Not Collectible” Status “Currently Not Collectible” (CNC) status serves as a

Receiving a notice of an IRS audit can trigger feelings of uncertainty and anxiety for

Dealing with the Internal Revenue Service (IRS) can often feel overwhelming, especially when you

Investing wisely not only involves choosing the right assets to grow your wealth but also

Tax season often brings about a mix of emotions for individuals across the country, and

Navigating the complexities of business taxes can often feel like trying to solve a puzzle

As an Idaho resident or business owner, understanding the various tax credits available can have

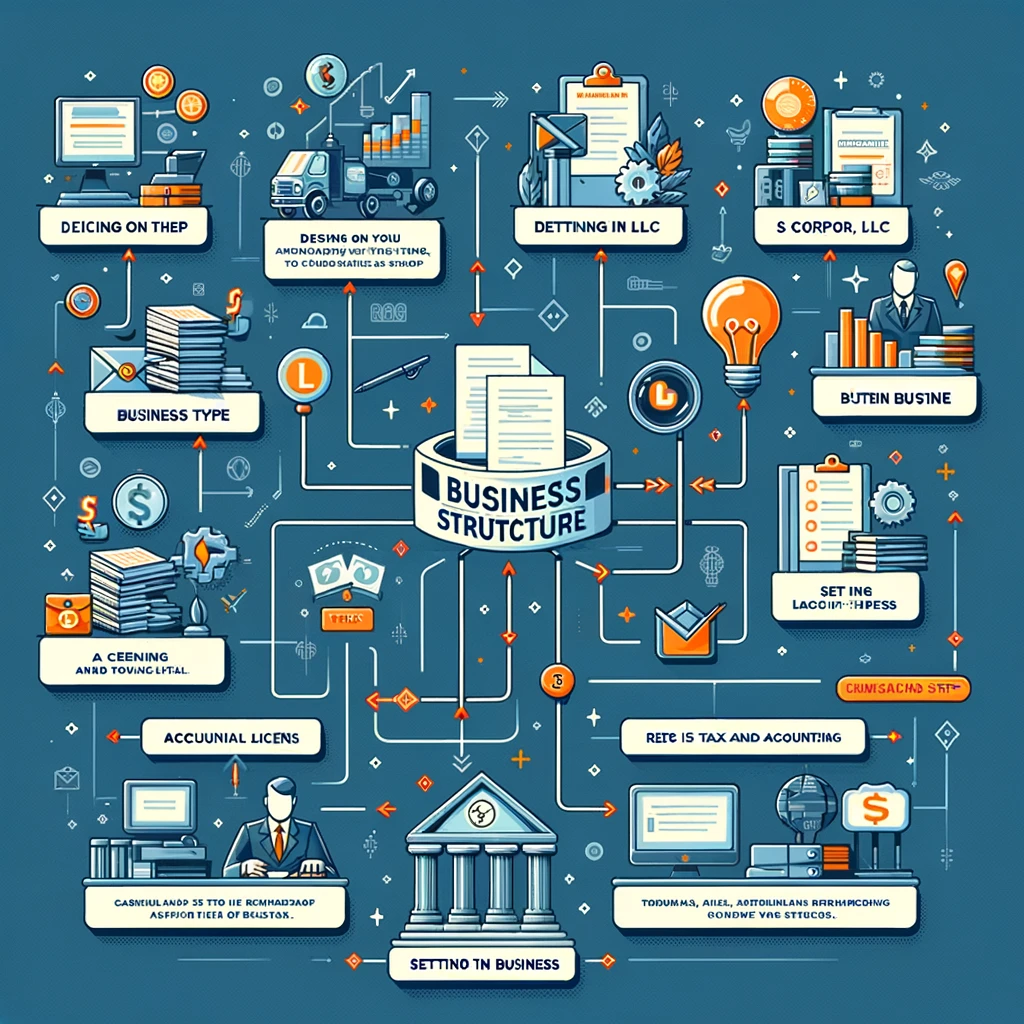

So, you’re thinking about starting a business in Idaho, and you’ve come across two popular

Taxes are an inevitable part of life, and understanding them is crucial for every taxpayer.

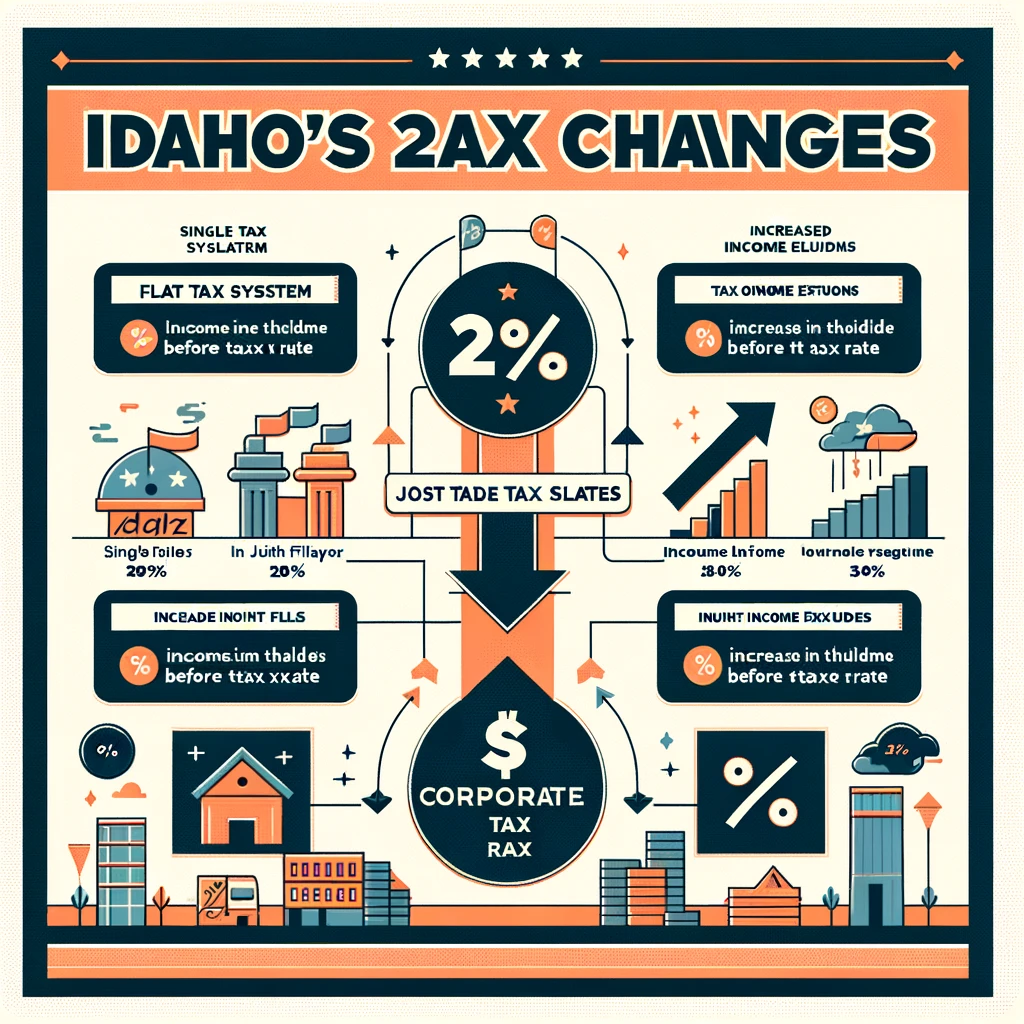

In 2024, Idaho introduced some major changes to its tax system, and understanding these changes

Navigating the complex world of business expenses is a critical task for entrepreneurs. The ability

Introduction Tax debts can be a significant source of stress, particularly in Idaho, where many

Introduction: Dealing with IRS back taxes can be a challenging and overwhelming experience. Whether you’ve

Understanding Tax Audits in Idaho When you hear about an audit from the Idaho State

Understanding IRS Offer in Compromise in Idaho Dealing with IRS tax debt can be an

Running a business in Idaho comes with its unique set of challenges and opportunities, especially

IRS tax debt can be a daunting subject for many. It arises when you owe

Embracing S-Corps in Business In Idaho’s competitive business world, not only is industry expertise crucial,

Taxpayers have the right to know what they need to do to comply with the tax laws. They are entitled to clear explanations of the laws and IRS procedures in all tax forms, instructions, publications, notices, and correspondence.

Curabitur non nulla sit amet nisl tempus convallis quis ac lectus.